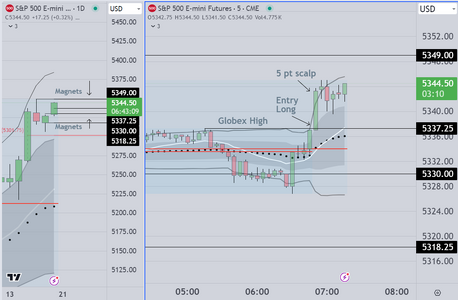

Today's open and first trade entry

As seen in the chart, the market gapped up

and ran. This would have been easier for retail traders

to see using 15 min candles

The problem for retail traders is that because they lack

experience, they do not know that a close above the 1st SD

confirms the breakout

As a result they are "trapped out". This means that instead of

recognizing the breakout and entering AT the next bar's open

they often chase the market, thus exposing themselves to

unnecessary risk. Also because they trade "for ticks", they almost

always do not hold long enough to take a "full scalp" (in this market

a full scalp is 3-5 points). Failure to hold means that when they do lose

on a later trade, they usually cannot overcome losses on the longer

(and more important) time frame. Thus they are net losers. This is an

important lesson that eventually they have to learn if they are going

to make a living in this business

A Final Note

I had several traders watching me today and they suggested that it was

difficult to "pull the trigger" on this trade setup. In response I said

"Okay then, lets review. Please remember that (at the time) I suggested

that this was a low probability setup, a little over 60% odds ordinarily

however the context is as follows,

The open is the time when highest volatility exists in the market as

institutions make decisions to put money to work. This is when THEY

need to see range expansion in order to make a reasonable profit

So the real odds are much better then one might expect, and in my

opinion it was worth it to take this trade, even though it is early

and we will likely have many other opportunities later.

Should have also mentioned that in the pre-open comment

we suggested that the overall bias was up. If you have our

standard display in front of you, you will note that the daily

chart shows this, as well as the upside magnets

Traded perfectly it was a 7pt winner, I took 5 pts (a standard scalp)

If I were wrong, I would have taken a 2 or 3 pt loss. in these circumstances

I suggest traders enter on small size and hold

Good luck traders

As seen in the chart, the market gapped up

and ran. This would have been easier for retail traders

to see using 15 min candles

The problem for retail traders is that because they lack

experience, they do not know that a close above the 1st SD

confirms the breakout

As a result they are "trapped out". This means that instead of

recognizing the breakout and entering AT the next bar's open

they often chase the market, thus exposing themselves to

unnecessary risk. Also because they trade "for ticks", they almost

always do not hold long enough to take a "full scalp" (in this market

a full scalp is 3-5 points). Failure to hold means that when they do lose

on a later trade, they usually cannot overcome losses on the longer

(and more important) time frame. Thus they are net losers. This is an

important lesson that eventually they have to learn if they are going

to make a living in this business

A Final Note

I had several traders watching me today and they suggested that it was

difficult to "pull the trigger" on this trade setup. In response I said

"Okay then, lets review. Please remember that (at the time) I suggested

that this was a low probability setup, a little over 60% odds ordinarily

however the context is as follows,

The open is the time when highest volatility exists in the market as

institutions make decisions to put money to work. This is when THEY

need to see range expansion in order to make a reasonable profit

So the real odds are much better then one might expect, and in my

opinion it was worth it to take this trade, even though it is early

and we will likely have many other opportunities later.

Should have also mentioned that in the pre-open comment

we suggested that the overall bias was up. If you have our

standard display in front of you, you will note that the daily

chart shows this, as well as the upside magnets

Traded perfectly it was a 7pt winner, I took 5 pts (a standard scalp)

If I were wrong, I would have taken a 2 or 3 pt loss. in these circumstances

I suggest traders enter on small size and hold

Good luck traders

Attachments

Last edited: